2020 Post-Pandemic Investment Paradigm Shift: Macro-Driven Strategies and Commodity Market Opportunities

解锁更多功能

登录后即可使用AI智能分析、深度投研报告等高级功能

关于我们:Ginlix AI 是由真实数据驱动的 AI 投资助手,将先进的人工智能与专业金融数据库相结合,提供可验证的、基于事实的答案。请使用下方的聊天框提出任何金融问题。

相关个股

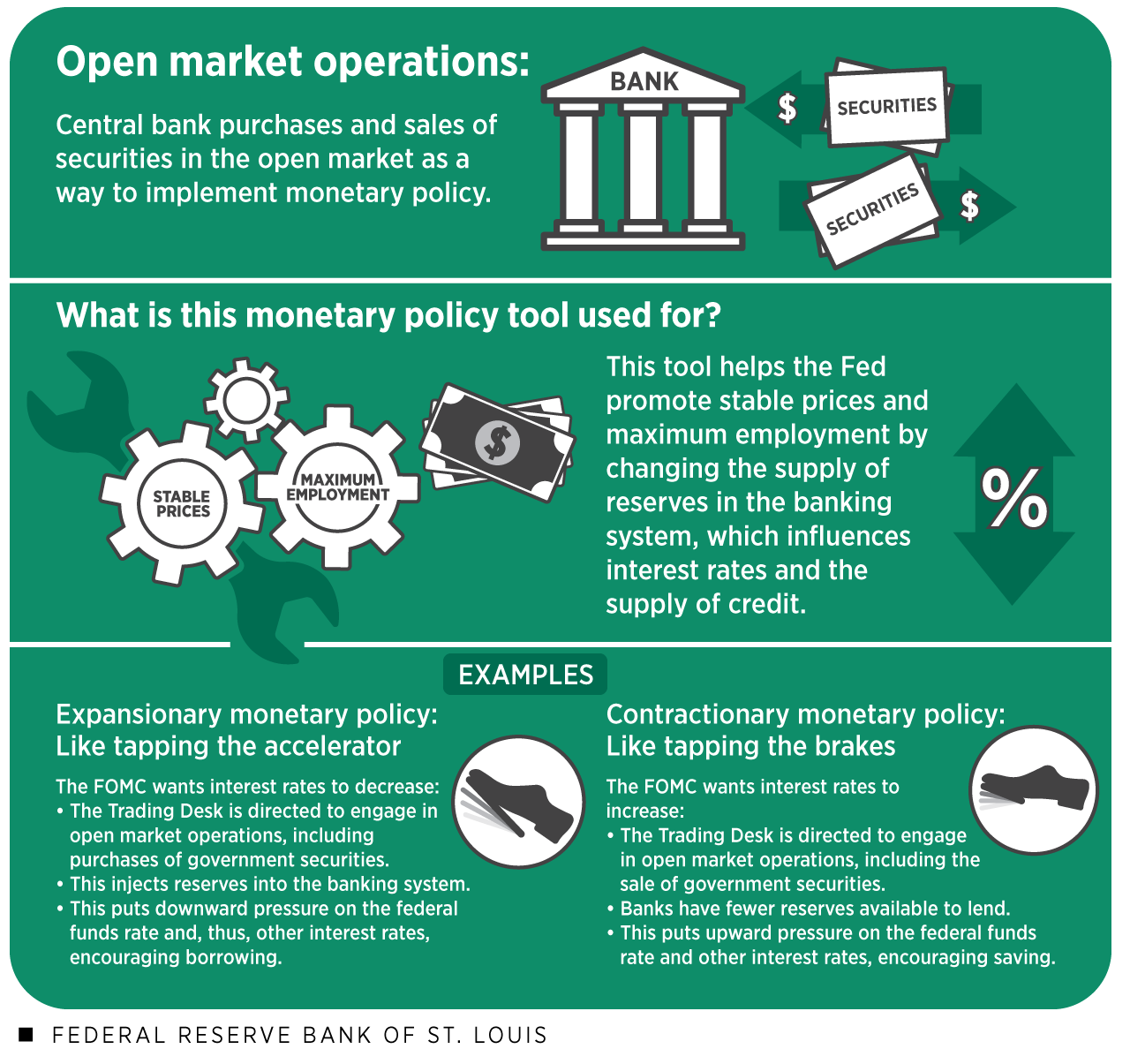

The 2020 pandemic triggered a shift from bottom-up individual stock research to top-down macro-driven investment strategies, driven by the Federal Reserve’s policy cycles (降息/扩表) and the trend of U.S. debt monetization [1][2]. Commodities are expected to enter a bull market, with recommended strategic rotation across precious metals (gold/silver), industrial metals (copper/aluminum), and energy (oil/coal) based on inflation stages [5].

- Fed Policy Cycle: From emergency rate cuts in March 2020 to aggressive hikes in 2022-23, then a shift to rate cuts in 2024 and a halt to balance sheet reduction in 2025 [1][2][3]. The Fed’s balance sheet peaked at ~$8.9T in 2022 and now stands at ~$6.6T [3].

- Commodity Performance: Gold has surged over 170% from 2020 to 2025 [6], silver is up 74% year-to-date [9], copper has gained over 20% [7], and aluminum ~10% [7]. Energy markets (WTI crude) saw high volatility with peaks in 2021-22 [8].

- Key Drivers: Inflation, geopolitical risks, and the global energy transition impacting commodity demand [5][6][7].

Social media insights align with research findings: both emphasize the macro-driven investment shift and commodity bull market. Research data validates the Fed policy cycle and commodity performance trends mentioned in social media [1][3][6][7].

- Opportunities: Strategic rotation across commodity sectors (precious metals → industrial metals → energy) [5][6][7][8].

- Risks: Unexpected Fed policy shifts [1][4], geopolitical tensions disrupting supply chains [5], and commodity price volatility [6][8].

数据基于历史,不代表未来趋势;仅供投资者参考,不构成投资建议

关于我们:Ginlix AI 是由真实数据驱动的 AI 投资助手,将先进的人工智能与专业金融数据库相结合,提供可验证的、基于事实的答案。请使用下方的聊天框提出任何金融问题。