Value Investing's Evolution: Macro Trend Insight & Buffett's Platform Ecosystem Focus

#Value Investing #Macro Trends #Buffett #Platform Ecosystem #Moat #Apple #Alphabet #Social Media Analysis

中性

A股市场

2025年11月16日

解锁更多功能

登录后即可使用AI智能分析、深度投研报告等高级功能

关于我们:Ginlix AI 是由真实数据驱动的 AI 投资助手,将先进的人工智能与专业金融数据库相结合,提供可验证的、基于事实的答案。请使用下方的聊天框提出任何金融问题。

相关个股

AAPL

--

AAPL

--

GOOGL

--

GOOGL

--

Reddit因素

The post claims value investing’s ultimate形态 is洞察社会宏观大趋势, not just traditional valuation metrics. Buffett’s Apple (platform value & user壁垒) and Alphabet (立于不败之地 regardless of AI bubble) investments illustrate focusing on structural moats. True value investing is dynamic, combining trends and competition.

研究发现

- Berkshire’s Portfolio Shifts: 2024 Q3首次建仓Alphabet (GOOGL) 1784万股 ($43B, 10th持仓), 减持Apple (AAPL) to 2.382亿股 (22.69% from 50%+). Apple viewed as consumer, not tech, by Buffett.

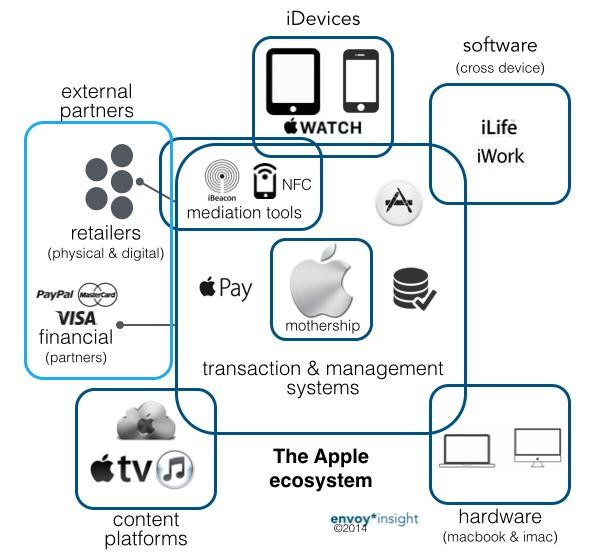

- Moat Evolution: Platform ecosystems include network effects (strongest), user粘性 (转换成本/data), AI era adds data飞轮/standards.

综合

Both post and research align on platform ecosystems as core moats. Buffett’s actions reflect evolving value investing (adapting to tech via platform understanding).

风险与机会

- Opportunities: Companies with robust platform ecosystems (network effects, user粘性).

- Risks: Misjudging moat durability, overvaluation in bubbles, missing trend shifts.

上一篇

没有上一篇

下一篇

没有下一篇

相关阅读推荐

暂无推荐文章

基于这条新闻提问,进行深度分析...

数据基于历史,不代表未来趋势;仅供投资者参考,不构成投资建议

关于我们:Ginlix AI 是由真实数据驱动的 AI 投资助手,将先进的人工智能与专业金融数据库相结合,提供可验证的、基于事实的答案。请使用下方的聊天框提出任何金融问题。

相关个股

AAPL

--

AAPL

--

GOOGL

--

GOOGL

--