A/H Share Liquidity Pressures & Defensive Opportunities: Tech + Dividends as Key Hedges

解锁更多功能

登录后即可使用AI智能分析、深度投研报告等高级功能

关于我们:Ginlix AI 是由真实数据驱动的 AI 投资助手,将先进的人工智能与专业金融数据库相结合,提供可验证的、基于事实的答案。请使用下方的聊天框提出任何金融问题。

相关个股

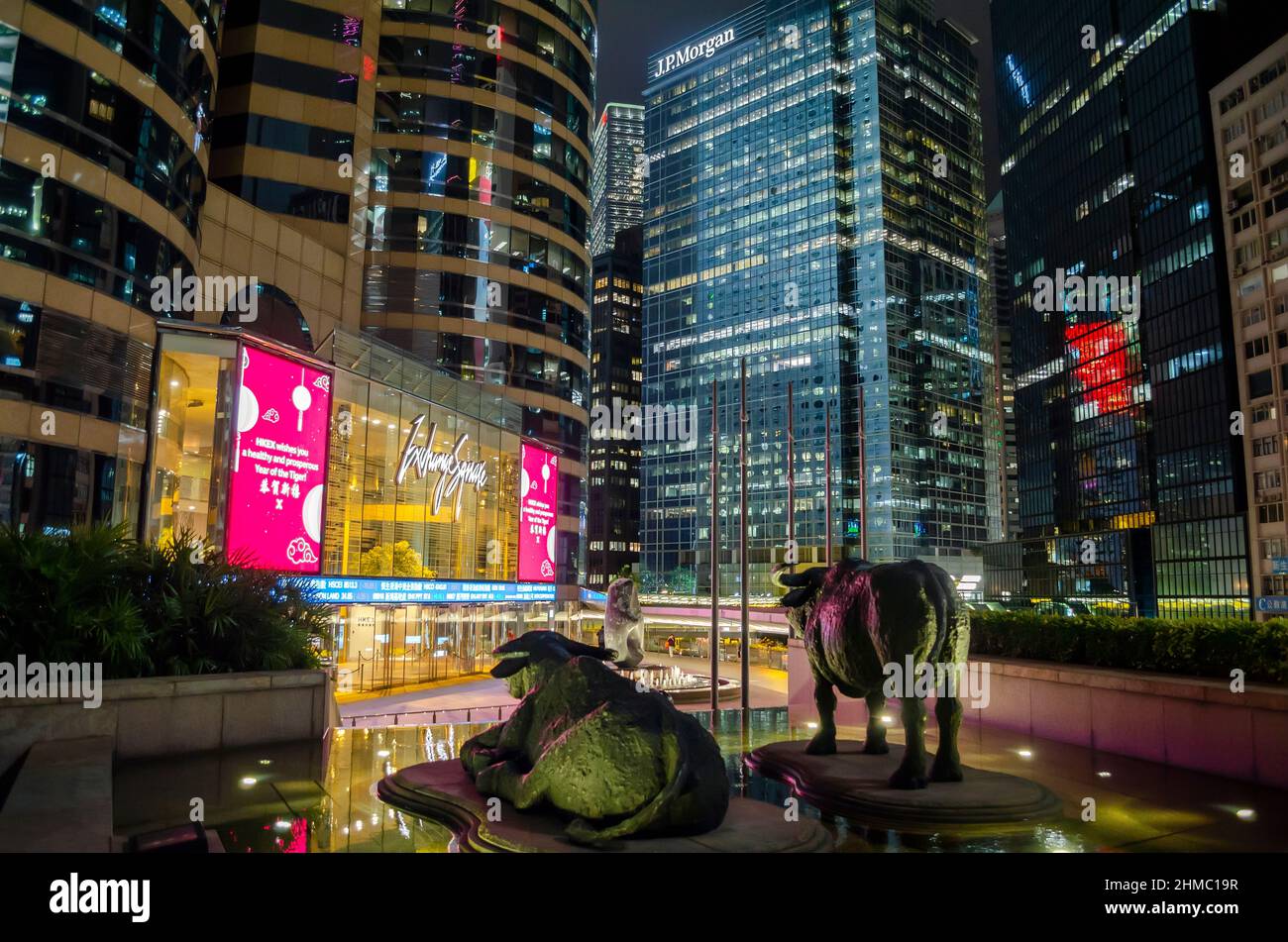

Both A股 and港股 grapple with liquidity pressures: A股 faces supply surplus from IPO expansions (e.g., 摩尔线程’s 80bn RMB IPO, STAR Market’s 2025 largest) and relaxed减持 rules.港股 is impacted by concentrated Chinese listings, offset by Southbound capital inflows exceeding 5trn HKD [6].

Profitable tech (AI firms with accelerating ROI) and high-dividend sectors (Hang Seng High Dividend Index) show resilience. Southbound capital adopts a "tech + dividend"哑铃 strategy, with turnover share rising to 23.6% [6].

Fed rate-cut expectations cooling add short-term pressure on港股 tech, but fundamentals remain intact. Investors should prioritize defensive positions in quality tech and dividend stocks amid volatility.

References: [1], [2], [3], [4], [5], [6], [7], [8]

数据基于历史,不代表未来趋势;仅供投资者参考,不构成投资建议

关于我们:Ginlix AI 是由真实数据驱动的 AI 投资助手,将先进的人工智能与专业金融数据库相结合,提供可验证的、基于事实的答案。请使用下方的聊天框提出任何金融问题。