ByteDance and Pinduoduo: Data-Driven Decision-Making Impact in 2024-2025

解锁更多功能

登录后即可使用AI智能分析、深度投研报告等高级功能

关于我们:Ginlix AI 是由真实数据驱动的 AI 投资助手,将先进的人工智能与专业金融数据库相结合,提供可验证的、基于事实的答案。请使用下方的聊天框提出任何金融问题。

相关个股

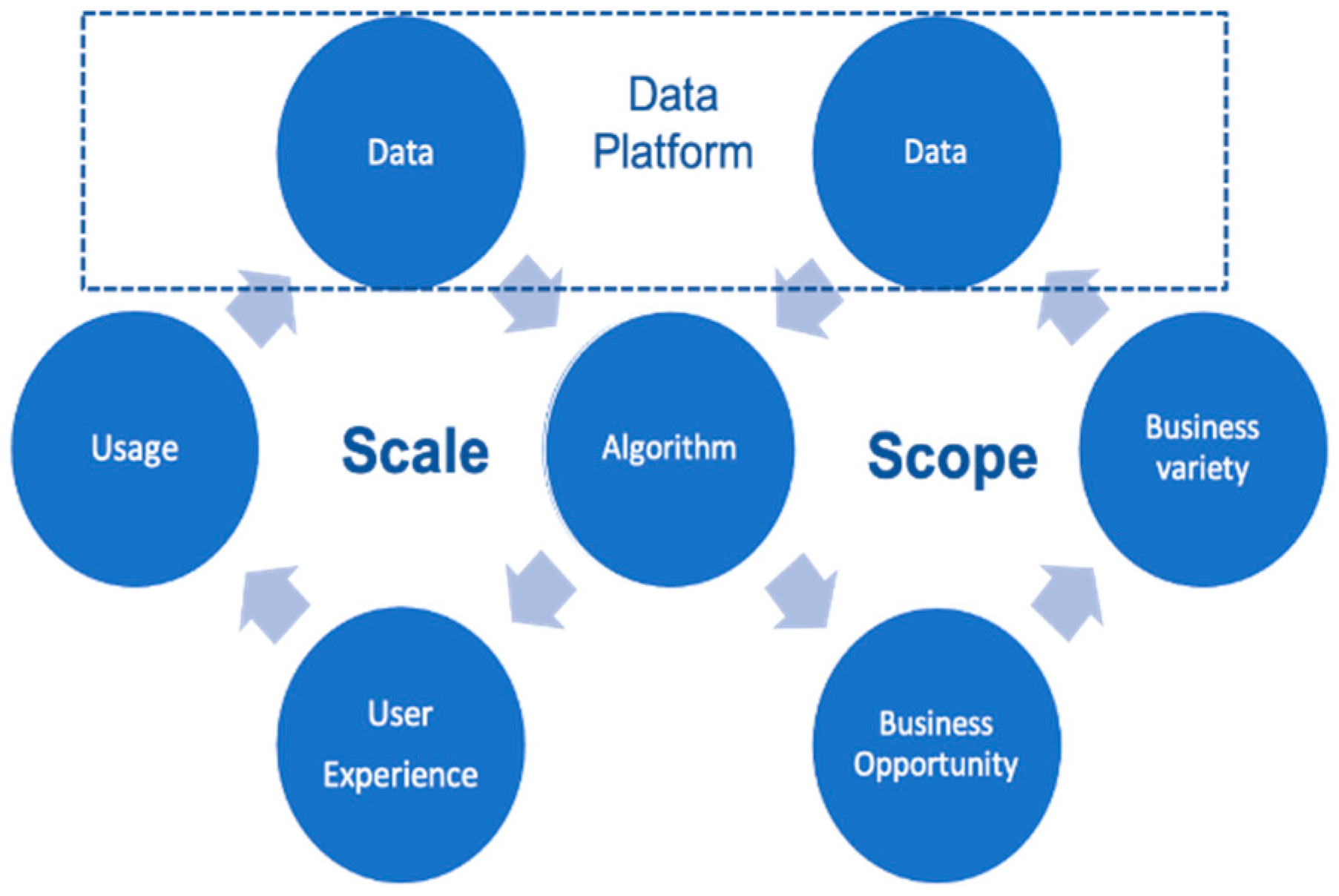

ByteDance demonstrated robust organizational efficiency through its large-scale AB testing platform and data-driven architecture in 2024-2025. The platform has accumulated over 150 million experiments, with more than 2,000 new experiments daily and 30,000+ concurrent tests [1]. This framework is applied across 500+ business lines, including core products like Douyin and Tomato Novel, leveraging a robust data-driven decision architecture [2].

Pinduoduo maintained revenue growth in 2024, though its net profit margin declined, reflecting market expansion investments [4]. The company has built a complete AB testing platform with components like experiment management, data linkage, and analysis engines [3]. Both ByteDance and Pinduoduo use non-intrusive data collection technology to enhance data quality and R&D efficiency [5].

Detailed 2024-2025 data on Meituan’s data-driven decision mechanisms and Alibaba’s experience-based judgment model is limited. A CSDN blog references a 98-page PPT on organizational structures of four giants (including Alibaba and Meituan) but lacks accessible content [6]. Alibaba made a strategic AI shift in November 2025, moving from Kuaike to building the ‘Qianwen’ native AI interaction entrance [7].

For additional context on investment pitfalls, refer to [8].

数据基于历史,不代表未来趋势;仅供投资者参考,不构成投资建议

关于我们:Ginlix AI 是由真实数据驱动的 AI 投资助手,将先进的人工智能与专业金融数据库相结合,提供可验证的、基于事实的答案。请使用下方的聊天框提出任何金融问题。