Cognitive Biases Impact Short-Term Investment Decisions: Systematic Strategies Mitigate Risks

解锁更多功能

登录后即可使用AI智能分析、深度投研报告等高级功能

关于我们:Ginlix AI 是由真实数据驱动的 AI 投资助手,将先进的人工智能与专业金融数据库相结合,提供可验证的、基于事实的答案。请使用下方的聊天框提出任何金融问题。

相关个股

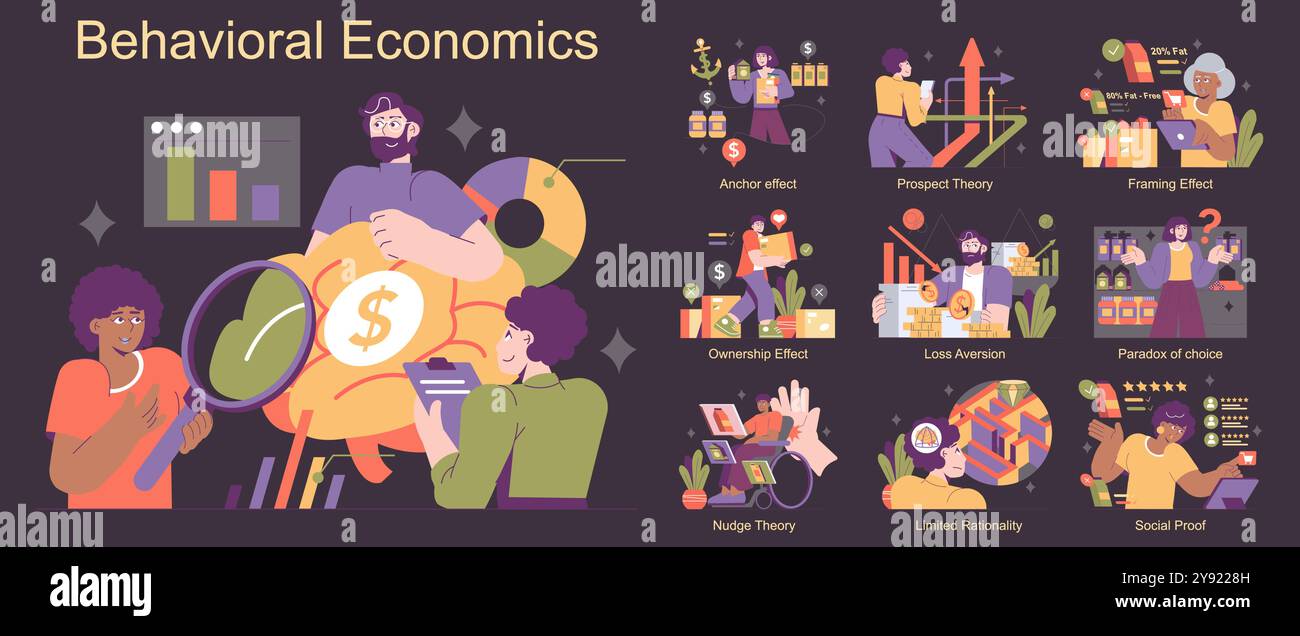

Short-term investment decisions are significantly affected by cognitive biases such as overconfidence, loss aversion, and confirmation bias, as well as emotional fluctuations [1]. These biases lead to cognitive fusion—where strong predictions block objective information, amplifying greed and fear, resulting in irrational trading behaviors [3][4].

To counter these issues, successful investors adopt systematic frameworks focusing on long-term probability-based gains instead of short-term predictions. Key strategies in 2025 include:

- 定投 High-Dividend Low-Volatility ETFs: These assets reduce emotional trading risks, with top-performing ETFs delivering monthly returns up to 3.7% [6].

- Grid Trading: Effective in volatile markets via mechanical buying/selling to avoid emotional interference.

- Value Averaging: Outperforms traditional定投 in cost control and收益 enhancement.

Recent research shows growing cross-disciplinary studies between behavioral finance, psychology, and neuroscience, emphasizing rule-based approaches to overcome biases like overconfidence and anchoring effects [2].

Investors should prioritize long-term probability-based gains over short-term predictions. Adopting systematic strategies helps mitigate cognitive biases and emotional impacts, ensuring rational decision-making [7].

数据基于历史,不代表未来趋势;仅供投资者参考,不构成投资建议

关于我们:Ginlix AI 是由真实数据驱动的 AI 投资助手,将先进的人工智能与专业金融数据库相结合,提供可验证的、基于事实的答案。请使用下方的聊天框提出任何金融问题。