PR=PE/ROE Strategy: Opportunities and Challenges in 2025 A-Share Market

#value investment #PR strategy #2025 A-share market #low interest rate #dumbbell allocation #value traps #quantitative investment

混合

A股市场

2025年11月22日

解锁更多功能

登录后即可使用AI智能分析、深度投研报告等高级功能

关于我们:Ginlix AI 是由真实数据驱动的 AI 投资助手,将先进的人工智能与专业金融数据库相结合,提供可验证的、基于事实的答案。请使用下方的聊天框提出任何金融问题。

Reddit Factors

Key insights from the Xueqiu post on PR=PE/ROE strategy include:

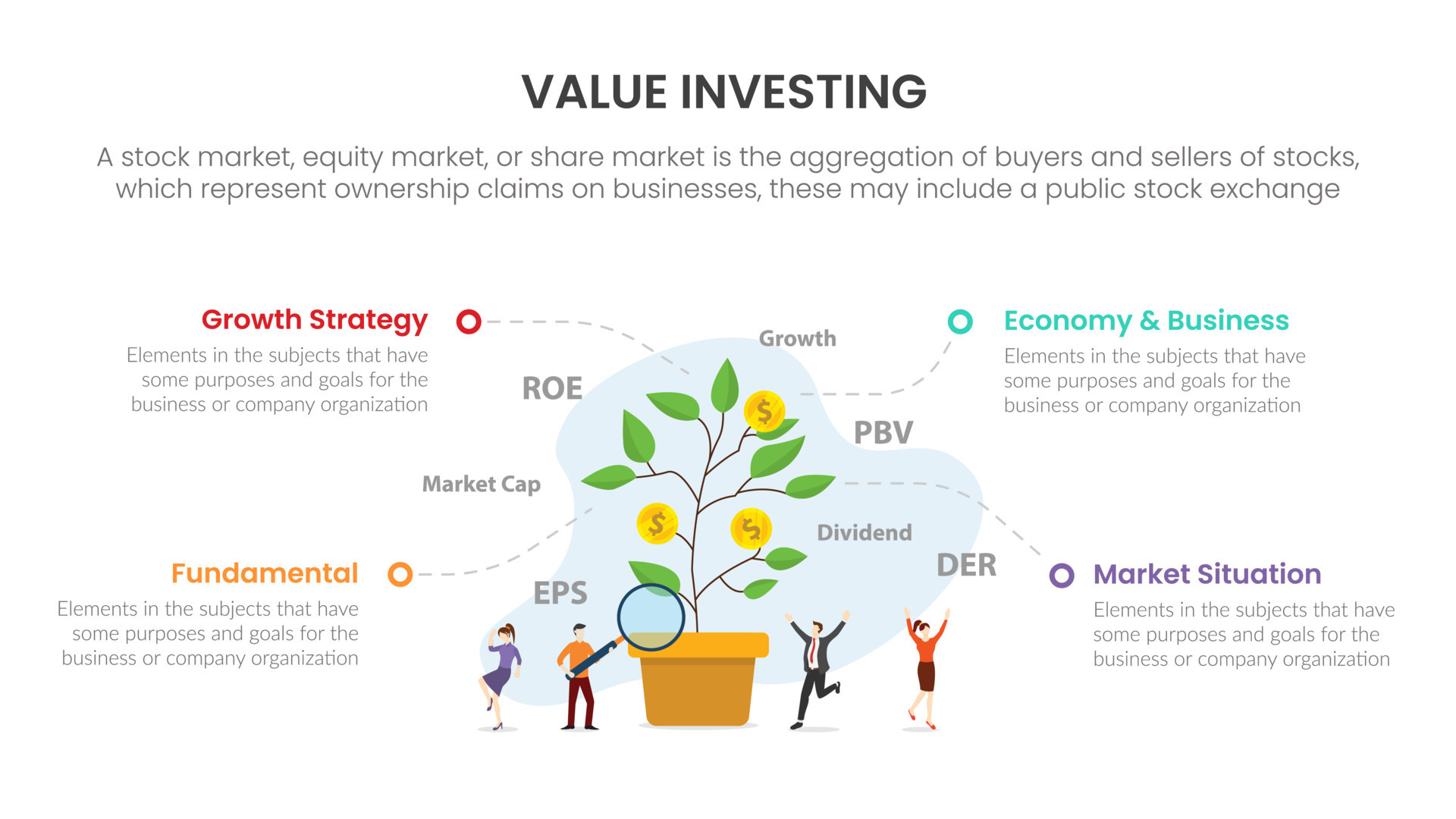

- Core Metric:PR=PE/ROE as a value investment indicator combining valuation and profitability.

- Signals:Buy when PR ≤0.6 (deep value) with sufficient cash flow; sell when PR≥0.8 or fundamental deterioration occurs.

- Screening:Focus on stocks with stable ROE, transparent governance, and low capital expenditure.

- Dynamic Adjustment:Adapt to enterprise type, dividend policies, and interest rate environment to avoid value traps.

Research Findings

From social media analysis:

- Market Challenges:2025 A-share market is in a shock phase with frequent sector rotation and daily turnover below 2 trillion yuan (stock fund game phase).

- Strategy Adaptation:Traditional PR value strategy needs integration with growth strategies; ‘dumbbell’ allocation (value + growth) is recommended.

- Low Interest Rate Impact:Pros (enhanced equity asset appeal) and cons (high valuations leading to scarce traditional value targets).

- Quantitative Opportunities:Fundamental quant strategies have space but require AI to improve选股 precision.

- Risk Mitigation:Prioritize ROIC vs WACC to avoid value traps; key risks include geopolitical conflicts, supply chain reconfiguration, and policy adjustments.

Synthesis

- Alignments:Both the Xueqiu post and research emphasize avoiding value traps and dynamic strategy adjustment.

- Contradictions:Theoretical PR strategy’s clear signals contrast with practical market volatility and sector rotation.

- Impact:Investors need to combine PR with AI-driven quant tools and mix value/growth assets to navigate current conditions.

Risks & Opportunities

- Opportunities:Low interest rates boost equity appeal; AI-enhanced quant strategies offer precision.

- Risks:Sector rotation disrupts value plays; high valuations limit traditional value targets; geopolitical/policy uncertainties.

上一篇

没有上一篇

下一篇

没有下一篇

相关阅读推荐

暂无推荐文章

基于这条新闻提问,进行深度分析...

数据基于历史,不代表未来趋势;仅供投资者参考,不构成投资建议

关于我们:Ginlix AI 是由真实数据驱动的 AI 投资助手,将先进的人工智能与专业金融数据库相结合,提供可验证的、基于事实的答案。请使用下方的聊天框提出任何金融问题。

相关个股

暂无相关个股数据